Ever wonder what is meant by certain words in your insurance policies? Here is a list of words and phrases common in the insurance industry, that may have a meaning other than you might expect.

Category Archives: Auto Insurance

September/October Newsletter

https://www.ltmonline.com/jerrysiver/2020SepOct

In this issue:

SECURE Act of small business

Retirement and the SECURE Act

SECURE Act and you

Obstacles to investing success

Cost of life insurance

Ways to lower your auto insurance bill

How to repair poor credit rating

Ways to lower car rental costs

And more….

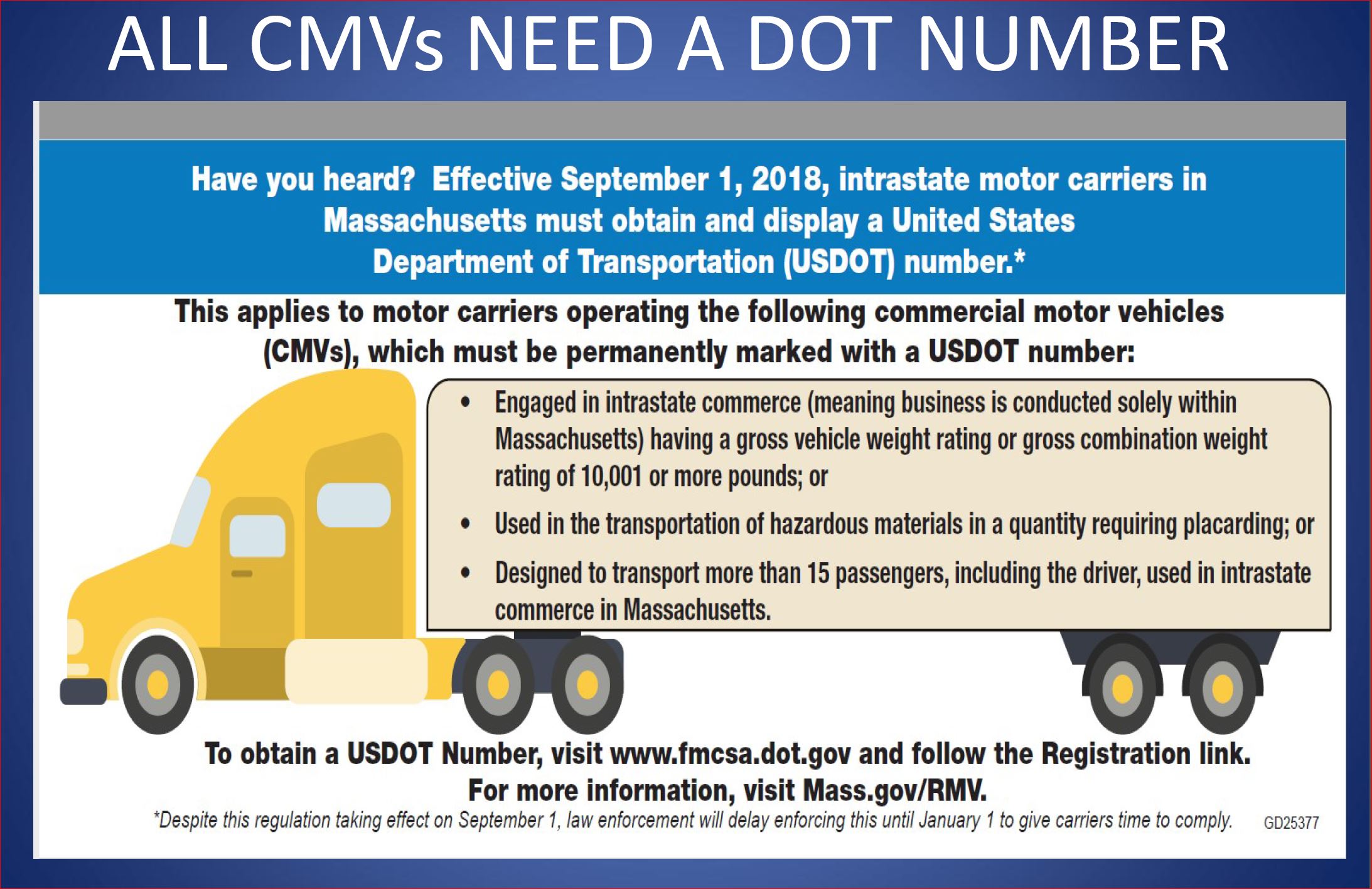

New MA DOT Requirements For Vehicles 10,000+ Pounds

Heavy Highway Motor Vehicle Registrations

Effective immediately heavy trucks (55,000 or more pounds) cannot be registered until the heavy vehicle use tax has been paid and FORM 2290 has been filed. Read this bulletin for details. REG122 – HVUT Important Info

2008 vs 2016 Mass Auto Policy Differences Explained

The Mass Agents Association has prepared this chart outlining the differences in these 2 policies. Click here to view on the Mass Agent Website

Let’s Talk Money, May Edition

On the move?

If you’re planning on buying and/or selling a home this summer, you want your move to be as smooth as possible. Since a house may be your largest financial investment, you’ll want to make the best decisions possible for you and your family.

Working for a living this summer

A summer job for your teen may offer more benefits than just earning money. A working teen may learn responsibility, build self-confidence and gain real world experience.

By the numbers: this new house

Here’s a snapshot of the housing market during the second quarter of 2016 from the U.S. Department of Housing and Urban Development.

Travel tips

These suggestions may help you enjoy your vacation without busting your budget this summer.

Up we go

Even a relatively low rate of inflation could affect your future buying power. Your financial professional can help you factor inflation into your financial strategy and retirement budget.

Insurance:

Make it easy on your beneficiaries

You can help ensure that your life insurance benefits go to the people you want to receive them by updating contact information, keeping beneficiaries informed and providing detailed information to the insurance company.

Let’s talk insurance Q&A

• What are the differences between term life and whole life insurance?

Retirement Planning:

Converting from a traditional IRA to a Roth IRA

You can convert a traditional individual retirement account (IRA) to a Roth IRA regardless of income or tax-filing status. While you may have to pay income taxes on the amount you convert, this can be a good strategy. Your financial professional can help you determine if a Roth conversion is right for your situation.

Let’s talk retirement Q&A

• Which accounts should I tap first for retirement income after I stop working?

Small Business:

Retirement plans for small businesses

If your small business doesn’t have a retirement plan in place, consider establishing one. A retirement plan can be a key part of your business’s ability to attract and retain talent. And offering tax-favored retirement benefits can provide greater retirement security for you and your employees.

Let’s talk business Q&A

• Can I fund a supplemental retirement plan with cash value life insurance? • What are some inexpensive but meaningful fringe benefits I can offer employees?

Standard:

Investing for the years ahead

Setting aside money for goals that are far in the future often takes a back seat to spending on current needs. However, investing for retirement should be one of your financial priorities. Talk to your financial professional about strategies that can help you pursue your long-term goals.

Let’s talk investing Q&A

• What are target date funds and how do they work?

Newsletter for May-June

Check out our latest newsletter here: https://www.ltmonline.com/jerrysiver

Helpful information on all these subjects:

Estate Planning:

Let’s Talk Estate Strategy Q&A

• What tax-efficient strategies can individuals use to pass assets to adult children?

• How can individuals let family members know where to access important documents in case of disability or death?

Protecting your child:

Mother’s Day and Father’s Day give us the opportunity to show Mom and Dad how much we appreciate them. But could moms and dads be doing more to protect their children? If you’re the parent of a minor child, you can help ensure your child’s future by naming a legal guardian and having sufficient life insurance.

General Interest:

A moving experience

• Moving to a new home can be both physically and financially draining. We offer some tips to help make the move less stressful.

Lost and found

• If a loved one dies and no life insurance policy is found, how can you determine if one exists? We list some strategies legal representatives can use to find the answer.

By the numbers: total annual college charges

How much does it cost to go to college? Here’s a look at some 2014 statistics from the College Board.

• The smart way to pay for college

Borrowing to pay for college is sometimes unavoidable. But a smarter and less expensive way to pay for your child`s education is to build a college fund through investing.

• Thoroughly modern money

Technology has made managing finances a lot easier. There are now many options that can help you budget, deposit checks and pay bills more efficiently.

Insurance:

Good health = lower premiums

Looking for a way to lower your life insurance premiums? By making a few healthy lifestyle changes, such as losing weight, exercising and quitting smoking, you may be able to qualify for lower insurance rates.

Let’s Talk Insurance Q&A

• Should first-time homeowners buy life insurance?

• Why are life insurance premiums generally higher for men than for women?

Retirement Planning:

Get your retirement account in shape

Is your retirement account as healthy as you’d like it to be? To help you get your investments in shape, we list some common mistakes to avoid.

Let’s Talk Retirement Q&A

• How much do retirement plan contributions reduce an individual’s income taxes?

Seniors:

Let’s Talk Retirement Q&A

• What is the difference between an assisted living facility and a nursing home?

• Why is the term” activities of daily living” important to understand when searching for a long-term care facility?

When what you leave behind matters

May is Older Americans Month. It’s the time we celebrate the accomplishments of individuals ages 65 and older. As a member of that generation, what’s important to you? Is it leaving your loved ones a financial legacy? You may not be able to if you haven’t factored medical and long-term care expenses into your retirement strategy.

Small Business:

Let’s Talk Business Q&A

• Are individual retirement accounts still protected by federal bankruptcy laws?

• How can employers increase participation in their retirement plans?

Spring into May with a healthy outlook

If it’s been a while since you reviewed your finances, now would be a good time for a checkup. We discuss some items that can get both your business and personal finances on the right track.

Standard:

Is your investing strategy fiscally fit?

May is National Physical Fitness and Sports Month. You know exercise and a healthy lifestyle can help keep you physically fit. But what can you do to ensure you’re fiscally fit? A review of your investments can help you determine if your current investing strategy is still in line with your goals.

Let’s Talk Investments Q&A

• What is a target date retirement fund’s glide path?

Womens:

Pamper yourself with a secure retirement

• Mother’s Day is the day your children recognize you for all you do. But sometimes the things you do, such as taking time out of the work force to care for children or an elderly parent, can affect your ability to invest for retirement. By starting early, maxing out your contributions and opening a spousal IRA, you can help build a financially secure retirement.

MA RMV Sticks It To Consumers Again

Another reason the average MA driver has to dislike the Registry of Motor Vehicles:

Registrar of Motor Vehicles, Celia J. Blue, just announced she will not reverse her decision to charge $25 for an updated registration on every car that changes insurance companies despite strong opposition from consumer and insurance agent groups against the abusive fee.

The RMV just raised fees on almost every transaction earlier this year and now they’ve added insult to injury by ramming another fee onto drivers. Ms Blue stated that to not charge the fee would reduce revenue to the RMV. This is another example of the Patrick administrations complete disregard for the taxpayers of MA. As long as he can keep spending more on government every year, he’ll be as happy as a pig in mud.

The only way this will ever be reversed is if you contact your state representative and complain. Post your thoughts on their Facebook pages and send them emails….it will make a difference.

MA Department of Revenue Tax Grab

In December 2013, a new $5 surcharge was added to the fine for civil motor vehicle infractions (CMVIs) that are from Chapters 89 and 90 of the Massachusetts General Laws. CMVIs are violations that are non-criminal, such as speeding or not obeying traffic signs.

Included below is a list of the moving violations under Chapters 89 and 90 that are surchargeable under merit rating and will also be impacted by this surcharge:

Major Traffic Violations

OUI while license suspended for OUI M.G.L. c. 90, s. 23

Child endangerment while OUI M.G.L. c. 90, s. 24V

Permit unlicensed suspended operation of MV M.G.L. c. 90, s. 12(b)

Permit operation without ignition interlock M.G.L. c. 90, s. 12(c)

Operate without ignition interlock M.G.L. c. 90, s. 24S(a)

Tamper with ignition interlock M.G.L. c 90, s. 24T(a)

Bypass ignition interlock for another M.G.L. c. 90, s. 24U(a)(1)

Minor Traffic Violations

Accident, hit and run M.G.L. c. 90, s. 24

Allowing vehicle to stand unattended, motor running M.G.L. c. 90, s. 13

Anything on or in vehicle or on person interferes with operation M.G.L. c. 90, s. 13

Attempting a speed record M.G.L. c. 90, s. 13

Blind pedestrians, must stop for M.G.L. c. 90, s. 14A

Brakes, operating without M.G.L. c. 90, s. 7

Crosswalk, motor vehicle not to enter if his car will block it M.G.L. c. 89, s. 11 Crosswalk, operator yield to pedestrian M.G. L. c. 89, s. 11Directional signals, devices required M.G.L. c. 90, s. 7

Directional signals, hand or mechanical required for lane change M.G.L. c. 90, s. 14B

Drag racing, speeding M.G.L. c. 90, s. 17B

Driving in “breakdown lane” M.G.L. c. 89, s. 4B

Driving within eight feet of street car stopped for passengers M.G.L. c. 90, s. 14

Emergency vehicles, right of way M.G.L. c. 89, s. 7

Exhibit another license M.G.L. c. 90, s. 23

Failure to ascertain if it is safe to change lanes M.G.L. c. 89, s. 4A

Failure to keep to the right when turning right M.G.L. c. 90, s. 14

Failure to keep to the far left when turning on a one/two way street M.G.L. c. 90, s. 14

Failure to fasten a trailer to a tow vehicle with proper safety chains M.G.L. c. 90, s. 7

Failure to give proper stopping or turning signals M.G.L. c. 90, s. 14

Failure to keep in right lane M.G.L. c. 89, s. 4B

Failure to keep to right when view is obstructed up to 400 feet M.G.L. c. 89, s. 4

Failure to stop at sign or signal at intersection M.G.L. c. 89, s. 9

Failure to use child restraint M.G.L. c. 90, s. 7AA

Fire apparatus, driving within 300 feet if going to a fire M.G.L. c. 89, s. 7A

Fire apparatus, failing to pull to right and stop M.G.L. c. 89, s. 7A

Fire Department, interfering with M.G.L. c. 89, s. 7A

Flashing red traffic signal, failure to stop M.G.L. c. 89, s. 9

Hand signals, failure to give M.G.L. c. 90, s. 14B

Headlights, dimming from high beam M.G.L. c. 90, s. 31

Headlights, one half hour after sunset M.G.L. c. 90, s. 7

Headphones, wearing while operating M.G.L. c. 90, s. 13

Height, operating vehicle when elevated or lowered M.G.L. c. 90, s. 7P

Hit and run, person injured M.G.L. c. 90, s. 24

Hit and run, property damage M.G.L. c. 90, s. 24

Horn, operating without M.G.L. c. 90, s. 7

Ignition key, remove from unattended vehicle M.G.L. c. 90, s. 13

Improper passing M.G.L. c. 89, s. 1

Inspection sticker, failure to display M.G.L. c. 90, s. 20

Inspection sticker, operating without M.G.L. c. 90, s. 7A and M.G.L. c. 90, s. 20

Intersecting way, slow down when approaching M.G.L. c. 90, s. 14

Junior operator’s license, operating in violation of M.G.L. c. 90, s. 8

Learner’s permit, motorcycle, violation of M.G.L. c. 90, s. 8B

Learner’s permit, operating in violation of M.G.L. c. 90, s. 8B

License, Class 1-2-3 M.G.L. c. 90, s. 8A

License, operating when not properly licensed M.G.L. c. 90, s. 10

License, violation of restriction M.G.L. c. 90, s. 8

Lights, operating motor vehicle with improper lights M.G.L. c. 90, s.s. 7 & 16

Making a turn from the wrong lane of traffic M.G.L. c. 90, s. 14

Making a right turn on a red light where prohibited M.G.L. c. 89, s. 8

Meeting other vehicles, exercise due care when M.G.L. c. 89, s. 1

Mirrors and reflectors, operating without proper M.G.L. c. 90, s. 7

Motorcycle, operating without proper equipment, lights and headgear M.G.L. c. 90, s. 7

Motorcycle, no more than two abreast M.G.L. c. 89, s. 4A

Motorcycle, no passenger unless machine so designed M.G.L. c. 90, s. 13

Motorcycle, single file when passing M.G.L. c. 89, s. 4A

Negligently operating M.G.L. c. 90, s. 24

Not reasonably to right for vehicle approaching from the opposite direction M.G.L. c. 89, s. 1

Noise, offensive, unreasonable (squealing tires) M.G.L. c. 90, s. 16

Not slowing and keeping right of center on approaching intersection or corner where view is obstructed M.G.L. c. 90, s. 14

Not yielding to oncoming vehicles when making a left turn M.G.L. c. 90, s. 14

Obstructing emergency vehicle M.G.L. c. 89, s. 7

One way street M.G.L. c. 89, s. 10

One way street, left turn from M.G.L. c. 90, s. 14

Operating after suspension or revocation of registration M.G.L. c. 90, s. 23

Operating on a bet or wager M.G.L. c. 90, s. 24

Operating car not properly registered M.G.L. c. 90, s. 9

Operating in violation of license restrictions M.G.L. c. 90, s. 8

Operating at speed greater than reasonable or proper M.G.L. c. 90, s. 17

Operating, motorcycle without permanent seat M.G.L. c. 90, s. 13

Operating motor vehicle without liability policy M.G.L. c. 90, s. 34J

Operating, no driving on sidewalks M.G.L. c. 89, s. 1

Operating, obey traffic signs, signals, markings M.G.L. c. 90, s. 18

Operating on ways divided into lanes M.G.L. c. 89, s. 4A

Operating through peekhole in snow on windshield M.G.L. c. 90, s. 13

Operating unregistered car M.G.L. c. 90, s. 9

Operating without proper mirrors and reflectors M.G.L. c. 90, s. 7

Operator not to obstruct passing vehicle M.G.L. c. 89, s. 2

Parking lights M.G.L. c. 90, s. 7

Passing vehicle stopped for a pedestrian in a crosswalk M.G.L. c. 89, s. 1

Passing bicycles, slow down M.G.L. c. 90, s. 14

Passing, commercial vehicles, excess 21/2 tons (except busses) use right lane pass in adjacent lane M.G.L. c. 89, s. 4C

Passing, don’t obstruct passer M.G.L. c. 89, s. 2

Passing horses, use care M.G.L. c. 90, s. 14

Passing on right, unless vehicle being passed is (a) making a left turn, (b) on one way street, (c) on a divided highway c. 89, s. 2

Passing school bus when flashers are on M.G.L. c. 90, s. 14

Passing vehicle forbidden if view is obstructed for less than 400 feet M.G.L. c. 89, s. 4

Pedestrian, must slow down for M.G.L. c. 90, s. 14

Permitting operation by a person who has no legal right M.G.L. c. 90, s. 12

Racing M.G.L. c. 90, s. 24

Railroad crossing, failure to slow down M.G.L. c. 90, s. 15

Railroad crossing, failure to stop while lights are flashing or gate lowered M.G.L. c. 90, s. 15

Rear lights, must have M.G.L. c. 85, s. 15

Rear lights, operating without M.G.L. c. 90, s. 7

Red flag or light, rear of load M.G.L. c. 90, s. 7

Red flashing signal, stop M.G.L. c. 89, s. 9

Right of way, fire engines, patrol wagons, ambulances M.G.L. c. 89, s. 7

Right of way, pedestrian in a crosswalk M.G.L. c. 89, s. 11

Safety glass, operating or permitting operation without M.G.L. c. 90, s. 9A

School bus, drivers responsibilities M.G.L. c. 90, s. 7B

School bus, railroad crossing, must stop and open door M.G.L. c. 90, s. 15

School bus, speed limited M.G.L. c. 90, s. 17

School zone, speed limit M.G.L. c. 90, s. 17

Siren law M.G.L. c. 90, s. 16

Slow down to pass pedestrian M.G.L. c. 90, s. 14

Slow moving vehicles, keep right on upgrade M.G.L. c. 89, s. 4

Speed at railroad crossings M.G.L. c. 90, s. 15

Speed, bridges M.G.L. c. 85, s. 20

Speed, certain vehicles to operate five m.p.h. below speed posted M.G.L. c. 90, s. 17

Speed, decrease for special hazards (pedestrians, traffic, weather) M.G.L. c. 90, s. 17

Speed, failure to regulate when men and equipment are on road M.G.L. c. 90, s. 17

Speed, faster than posted M.G.L. c. 90, s. 17 and M.G.L. c. 90, s. 18

Speed, greater than reasonable and proper M.G.L. c. 90, s. 17

Speed limit 15 m.p.h. near vehicle peddling merchandise, when flashing lights M.G.L. c. 90, s. 17

Speed limits, thickly settled district, school zone M.G.L. c. 90, s. 17

Speed, special regulations M.G.L. c. 90, s. 18

Speed, school bus M.G.L. c. 90, s. 17

Stolen car, operating M.G.L. c. 90, s. 24

Stop before passing school bus M.G.L. c. 90, s. 14

Stop signs M.G.L. c. 89, s. 9

Street car, care in passing M.G.L. c. 90, s. 14

Street car, eight foot stopping law M.G.L. c. 90, s. 14

Television in operator’s view M.G.L. c. 90, s. 13

Throughways, right of way M.G.L. c. 89, s. 9

Tires too wide M.G.L. c. 90, s. 19

Traffic signals, flashing red is same as stop sign M.G.L. c. 89, s. 9

Tread depth, tires M.G.L. c. 90, s. 7Q

Turning improperly M.G.L. c. 90, s. 14

Unattended vehicle, stop engine, set brakes, remove key from switch and from vehicle M.G.L. c. 90, s. 13

Vehicles excluded area, operating or permitting one’s vehicle to be operated where posted M.G.L. c. 90, s. 16

Commerce has a new accident forgiveness add-on for thier auto policies that is really great. It’s not for everyone but if you’re one of the people it would benefit, it’s a great deal. Ask us.